About Us

Oilbi at a Glance

Oilbi is a proactive, partner-driven independent energy company focused on developing Tanzania's natural gas resources in a responsible and sustainable way. By doing so, we will continue to drive regional economic growth and support the global energy transition.

Company History: Key Milestones

Started African business in Namibia and the Republic of Congo under the name 'Apex Group'.

Apex Group set up an office in Dar es Salaam to initiate business activities in the field of offshore natural gas development in Tanzania.

A consortium of BG Group and Ophir energy discovered a large gas field named Papa in offshore Block 3, and Apex Group participated as a strategic investor partner.

Apex Group changed its name to 'Oilbi'.

Oilbi secured 100% operational control of Block 3 by acquiring all shares from partner Ophir energy, leading to the drafting of a model PSA for Block 2R and Block 3.

Oilbi commissioned General Electric(GE) and Baker Hughes to perform a preliminary feasibility study and basic design for the LNG plant construction project.

A Production Sharing Agreement(PSA) between Oilbi and Tanzanian government is now in its final stage, ready for signing.

Executive Leadership

Jae Lee

Founder & Chairman

Born in Seoul Korea, in 1952. His decades of business experience in Africa and long-term dedication to Tanzania's energy sector provide Oilbi with invaluable local insight, strong government relationships, and crucial cross-border connections.

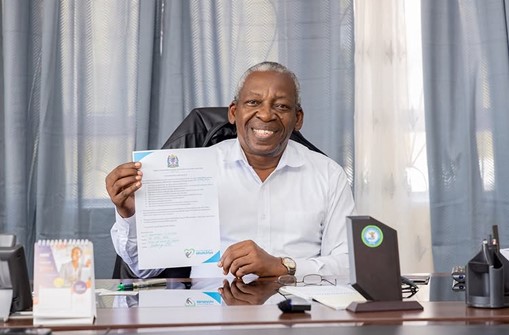

Makongoro Nyerere

Board Member

Born in 1959 in Tanzania. He is the eldest son of Julius Nyerere, the Founding President of Tanzania. His family legacy and personal network play a key role in strengthening Oilbi's partnerships with government authorities and local stakeholders.

Oilbi's Gas Blocks

Oilbi holds 100% exploration and operation rights for offshore Blocks 2R and 3R in southeastern Tanzania.

Block 3R (Papa Field)

Proven Reserves (P1)

Approximately 3.5 Tcf of natural gas

LNG Output Potential

70 million tons of LNG (26-27 years at 2.5 million tons per year)

Probable Reserves (P2)

Approximately 18.2 Tcf of natural gas

Block 2R

Probable Reserves (P2)

Approximately 17.8 Tcf of natural gas

Production Sharing Agreement (PSA)

Overview

PSA is a core legal contract between Oilbi Ltd, the Ministry of Energy, and the Tanzania Petroleum Development Corporation(TPDC). This agreement secures Oilbi's exclusive rights for exploration and development of natural gas in offshore Blocks 2R and 3R.

Key Points

Exclusive Rights

Exclusive exploration and development rights in Blocks 2R and 3R

Royalty

Fixed at globally competitive 7.5%

Cost Recovery

High recovery Capex of up to 75% of total production

International Arbitration

Dispute resolution under ICC rules with foreign exchange freedom

Oilbi LNG Project - Mvua Kubwa Project

The Oilbi LNG Project, named Mvua Kubwa Project (meaning "heavy rain" in Swahili) is a fully integrated liquefied natural gas development with an annual production capacity of 2.5 million tons, targeting initial production by early 2031.

Project Cost

Total estimated cost: USD 3.6 billion

- Construction costs: USD 3.3 billion

- Non-construction costs: USD 300 million

Key Financial Indicators

- Annual Revenue (full capacity): $1.75 billion

- NPV (Net Present Value): $3.5 billion

- IRR (Internal Rate of Return): 20.88%

- Break-even Point: Year 5

Project Location

The plant will be located in Mtwara, a southeastern coastal region of Tanzania, offering direct access to international shipping routes and proximity to growing Asian LNG markets.

Expected Project Timeline

Sign PSA with Tanzanian government and strengthen core project team

Full-scale discussions with KOGAS and major Korean/Foreign partners

Complete Host Government Agreement and secure long-term off-take agreements

Full-scale plant, marine, and sea-bed pipeline construction

Begin commissioning and achieve first LNG production

Partnership and Investor Relations

We are seeking strategic partners to join us in unlocking Tanzania's vast natural gas resources. Our vision is to connect local potential with global opportunity.

Who We Are Looking For

Technology & Expertise

Partners with proven capabilities in natural gas exploration, production, and LNG plant construction.

Market Access

Partners who can provide access to key international markets and distribution networks, particularly in Asia.

Investment

Financial partners who will enable us to secure the capital required for this large-scale project.

Capital Structure & Financing Plan

Company Strategy

Focused on expanding resources, diversifying our portfolio, leading in ESG, building regional synergy, and strengthening sustainable partnerships.

Resources Expansion

Further exploration and drilling to grow reserves and extend project life.

Portfolio Diversification

Balanced offtake, trading, and spot access to optimize revenue and reduce volatility.

ESG Leadership

Invest in CCS, workforce development, and community programs.

Regional Synergy

Collaborate regionally to build an efficient energy hub and logistics.

Sustainable Partnership

Deepen ties with Korean and global leaders for capital and markets.